Who’s to Blame for Higher Heating Costs This Winter?

Despite what the fossil fuel industry would like you to believe, rising natural gas prices have nothing to do with pro-climate policies.

Homes in St. Paul, Minnesota, during the polar vortex in January 2019

Brian Peterson/Star Tribune via AP Photo

As winter approaches and retail prices for energy remain at multiyear highs, many people are looking at their utility bills with increasing concern. In its most recent Winter Fuels Outlook, the U.S. Energy Information Administration predicts that U.S. households that rely on natural gas to stay warm (which is nearly half of them) can expect to spend 30 percent more for heat than they spent last winter, and as much as 50 percent more if their local temperatures this season are just 10 percent lower than average.

Anticipating public frustration, oil and gas companies—and the politicians who take their cash—are trying to pin the blame on policies designed to promote renewable energy and reduce the extraction and consumption of fossil fuels. Don’t buy it.

The Industry’s Story

Last month, as world leaders were preparing to convene in Glasgow to discuss how to curb greenhouse gas emissions and minimize the worst consequences of climate change, some apologists for the fossil fuel status quo decided it was a good time to link rising fuel prices to the Biden administration's vigorous pursuit of clean energy. Senator John Barrasso of Wyoming—who’s received nearly $1.2 million in contributions from the oil and gas industry since taking office in 2007—issued a lengthy diatribe on the Senate floor blaming Biden and unspecified “environmentalists” for “shut[ting] down the abundant and affordable energy sources that fuel our economy” and for turning the United States from “a nation of energy wealth and energy dominance” into “a nation of energy weakness.” On the same day as Barrasso’s outburst, Representative Garret Graves of Louisiana called rising fossil fuel prices “an unforced error” by the administration and accused it of “trying to manipulate markets and force us in a direction of taking on things like solar and wind energy and other renewable sources.”

To Mark Szybist, a senior attorney in NRDC’s Climate & Clean Energy Program who advocates for cleaner and more efficient energy markets, their arguments are just a bunch of hot air. “Blaming clean energy policies for the current spikes in fossil fuel prices is like blaming a holiday hangover on eating the spinach dip rather than drinking the rum punch,” he says. “In both cases, the only connection between the two things is that they're happening at the same time.” The problem, he says, “is that while everyone knows where hangovers come from, most people aren't experts in oil and gas commodity markets. That creates an opportunity to sow disinformation, and fossil fuel interests have seized it.”

Some of these disinformation sowers are trying to place the blame for high energy prices on certain pro-climate actions taken by the Biden administration—such as the temporary moratorium on new oil and gas drilling, which went into effect shortly after the new president took office. But as John Bowman, NRDC’s managing director for government affairs, noted in a recent article, this “pause” (which was lifted in June, by the way) applied only to new leases on federal property, whereas the vast majority of drilling occurs on privately owned land. In fact, domestic natural gas production overall is at near-record high levels right now.

But hold on. If the sun and the wind and the president aren’t to blame for higher natural gas prices, then what’s behind the increase?

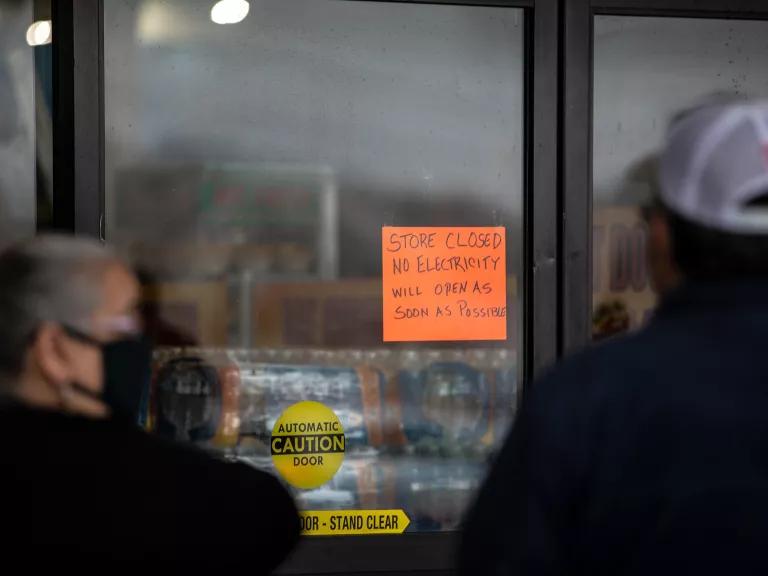

People waiting in line for Fiesta Mart to open after the store lost electricity in Austin, Texas, due to the winter storm, February 17, 2021

Montinique Monroe/Getty Images

The Real Story

Predicting the price of the natural gas that’s used to heat homes during cold weather—like predicting the weather itself—is a tricky business. There are few commodities as susceptible to price fluctuations as oil and gas. “The oil and gas extraction industry has been a boom-and-bust business since the world's first commercial oil well was drilled in 1859, and boom-bust cycles inevitably mean volatile prices,” Szybist says. One example is the recent dramatic swings in the price of methane, which has gone from a high of more than $20 per thousand cubic feet (mcf) to a low of less than $2 per mcf over the last 16 years, and which in just the past 18 months has shot up more than 300 percent, from $1.76 to $5.62. “This isn't an aberration,” Szybist adds. “It's the nature of the oil and gas market.”

Unsurprisingly, in our current era of COVID-19-related disruptions to consumer behavior and business patterns, the cause of the most recent spike in natural gas prices is overdetermined. But it all boils down to a basic mismatch between supply and demand. In 2020, worldwide efforts to contain the coronavirus sharply reduced economic activity, most of which is still powered by oil and gas. “As a result, there was much more oil and gas supply than there was demand, prices plummeted, and drillers cut production,” says Szybist. With regard to natural gas specifically, once vaccinations increased and the country began to resume more normal economic rhythms in 2021, demand started to pick up again. Domestic production of natural gas ramped up accordingly. Yet domestic supply remained lower—and prices climbed higher—than usual.

If you’re thinking to yourself, “Wait, that doesn’t make sense,” you probably don’t earn a salary (or reap a hefty dividend) from the fossil fuel industry. Here’s what happened: With fewer domestic customers to service during the bulk of 2020, natural gas producers in the United States turned their attention to Europe and Asia, where their product could fetch a much higher price than it could at home. Profits from these overseas exports helped sustain the industry throughout the pandemic. Transporting gas by boat (or by rail or truck) does a number on the climate, but the move kept stockholders happy. Of course, once U.S. demand for natural gas came roaring back in 2021, these companies didn’t want to leave the lucrative foreign markets they had just entered.

A liquefied natural gas (LNG) cargo ship from Russia berthed at an LNG terminal in Tianjin, China, January 2021

Visual China Group via Getty Images

Which brings us to this moment, when domestic supply is lagging and costs are rising “largely because drillers are operating with the goal of maximizing shareholder returns rather than meeting the local market demand,” says Szybist.

Now, nearly two years into the pandemic and still reeling from so much uncertainty, millions of consumers are faced with a new uncertainty: Will they be able to afford to keep themselves and their families warm this winter? In low-income communities, especially, the prospect of paying as much as 50 percent more for heating over the course of months isn’t a mere annoyance. It’s a serious cause for worry.

The irony is that the same clean energy currently being used as a scapegoat by some could have helped us ameliorate the predicament we’re in now. “If we had invested in clean energy over the last few decades at the rate we should have been, we wouldn't be as dependent on oil and gas as we still are today,” Szybist says. “And the consequences of the current price crunch wouldn't be as severe as they are.” We’d be able to stay warm this winter and be that much closer to staving off catastrophic climate change, which would also keep us cozy.

This NRDC.org story is available for online republication by news media outlets or nonprofits under these conditions: The writer(s) must be credited with a byline; you must note prominently that the story was originally published by NRDC.org and link to the original; the story cannot be edited (beyond simple things such as grammar); you can’t resell the story in any form or grant republishing rights to other outlets; you can’t republish our material wholesale or automatically—you need to select stories individually; you can’t republish the photos or graphics on our site without specific permission; you should drop us a note to let us know when you’ve used one of our stories.

How to Ditch the Biggest Fossil Fuel Offenders in Your Life

What Are the Solutions to Climate Change?

Decarbonization: Why We Must Electrify Everything Even Before the Grid Is Fully Green