Getty Images

Sustainable Finance

Overview

Many of the strategies we need to deploy to limit the global temperature increase to no more than 1.5 degrees Celsius, avoid ecosystem and biodiversity collapse, and ensure an equitable future require funding. At every stage—development of technology, validation, implementation, and scaling—the expenses must be covered, and the costs and benefits of the necessary transitions must be shared equitably. Increased risks from intensifying extreme weather events threaten the stability of businesses, the security of borrowers, and the health of banks and their loan portfolios. And as financial systems shift along with our changing climate, we need to be prepared for wide-reaching impacts. NRDC works with the public and private sectors to spur innovations that will help economies adapt to this new world, and deliver a greener, more prosperous future that benefits all.

Solutions

We have the tools to shift global financial systems, better protect the global economy from the risks of climate change, boost investment in clean energy, and accelerate adaptation measures in the places on the crisis’s frontlines. Here are our current priorities:

Integrate climate risk into financial regulations

With our advocacy partners, we’re providing federal banking regulatory agencies with recommendations on how to incorporate climate risk into examinations of individual banks. This guidance is geared to stave off a collapse like the 2008–2009 mortgage crisis by helping identify unsound activities or assets that could destabilize these institutions and the banking system as a whole. We also have been pushing for the U.S. Securities and Exchange Commission (SEC), a regulator of the stock market, to mandate disclosures showing investors how public companies are planning for the impacts of climate change. Finally, we’re raising awareness of environmental impacts from the burgeoning crypto industry and championing ways to rein them in. We advocate for federal and state regulators to guide the industry away from its current energy-intensive method of verifying transactions and to focus on tackling its massive e-waste problem.

Boost investment in climate solutions

From our work to scale up federal investment into renewables and clean energy for all to our partnerships that help low-income communities of color access energy efficiency upgrades and reduce utility costs to our policy guidance helping 25 U.S. cities step up climate action in their building and transportation sectors, we’re advancing a wide variety of climate solutions. We’re also working to scale up funding for climate-resilient infrastructure and green energy markets in India, such as through supporting sustainable cooling initiatives and by providing a road map to help bring in new investors and attract international capital for the country’s offshore wind market. Ultimately, we seek to finance the development of new green economic sectors globally that bring greater job opportunities and durable growth.

Did You Know?

We need $100 trillion to $150 trillion to limit warming and build resilience. Meanwhile, in the six years after the Paris climate agreement, the world’s 60 largest private-sector banks spent $4.6 trillion in financing fossil fuel projects and exacerbating our climate crisis.

Accelerate China’s key role in climate finance

NRDC collaborates closely with Chinese partners to support the climate-friendly transition of its financial institutions and carbon-intensive enterprises. As part of this work, we’ve joined with the Climate Investment and Finance Association to convene stakeholders from domestic and international research institutes, government agencies, and banks to deepen the country’s implementation of and investment in its carbon neutrality goals. And we’ve worked to demonstrate how public funds work alongside private capital to accelerate the growth of clean energy markets throughout the country.

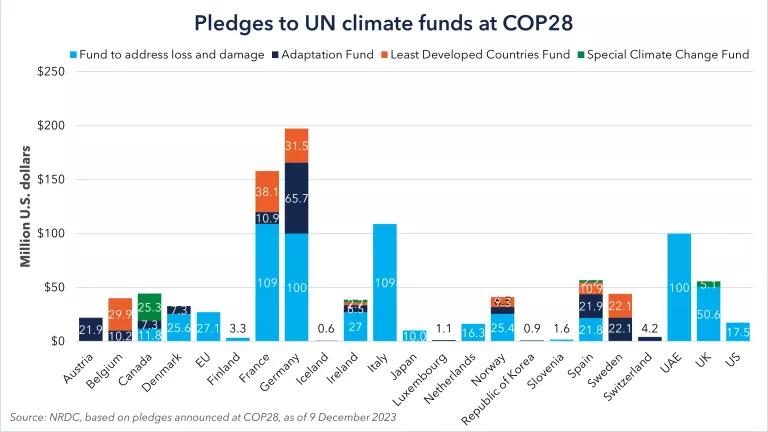

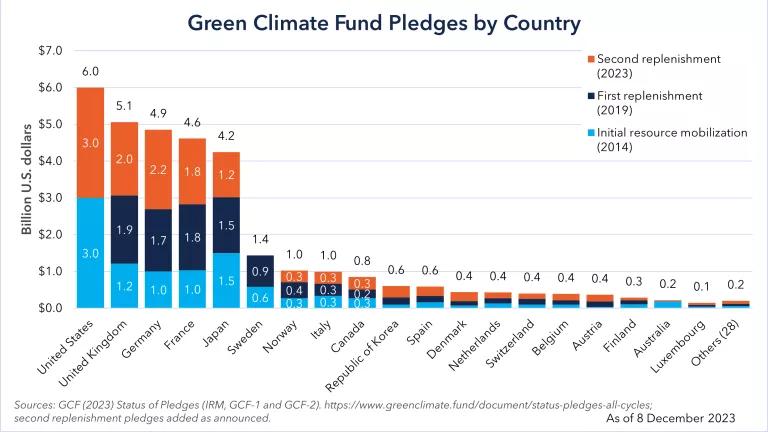

Ramp up international climate funding from the federal government

While wealthy nations have fallen short of their international climate finance pledges made at past United Nations summits, we cannot let them off the hook. Given the size of the U.S. economy and its historical contribution to the climate crisis, NRDC is calling on our federal government to do more—specifically, to invest at least $12 billion per year by 2024—in order to fund mitigation and adaptation measures in those countries that are least responsible for, yet hardest hit by, climate change. With larger investments, developing countries can more quickly achieve the global emissions cuts we need within this decade and adapt to unavoidable climate impacts.

Use public funds to catalyze private investment

We’re working with a wide range of stakeholders to help transform the role of public finance institutions at the local, regional, and global levels to build up private investment in climate action. Through the Green Bank Network that we cofounded in 2015, we’re fostering collaboration among existing green banks, which are specialized green finance institutions and facilities with a proven track record of helping to leverage and direct funding into clean energy projects and other climate solutions. We’re also helping to expand the green bank model to new jurisdictions to help build a green workforce and address the local impacts of climate change head-on.

Erode the economic power of the fossil fuel industry

NRDC is helping to drive forward legislation that will eliminate antiquated, costly subsidies to the fossil fuel industry. And we’re supporting the divestment movement—including at the state level—a critical response to the climate crisis. Through our just transition work, we seek to ensure that fossil fuel workers and their communities are supported as local industry transitions away from these dirty energy sources. We are also supporting public and private sector efforts (including through tax incentives) to migrate electricity generation to renewables, increase grid resiliency, increase production and uptake of electric vehicles, and promote electrification and energy efficiency of buildings—all to facilitate the transition away from dirty energy.

“There is much work to be done to protect our financial system, the economy, retirees, the most vulnerable, and all of us from the financial risks from climate change. We need the whole of government and the private sector to deal with this massive set of risks, and to shield the more than 330 million people in our country from climate change–driven financial disaster.”

Sarah Dougherty, director, Green Finance Center, People & Communities Program

Progress

- After NRDC and a coalition of leading environmental, financial, and public interest groups called for action, bank regulators issued draft guidance to require the largest banks to consider climate risk, with the expectation that bank examiners will hold them accountable.

- The SEC proposed a comprehensive public disclosure rule that would give investors information about companies’ emissions and how they are planning for the financial effects of climate change.

- Green Bank Network members have already mobilized more than $134 billion to support renewable energy and energy efficiency initiatives, and more.

- In 2021, at COP26, in recognition of the fact that adaptation remains significantly underfunded (receiving only around a quarter of climate finance), developed countries pledged to double adaptation finance for developing countries by 2025, to around $40 billion per year.

- The following year, at COP27, global leaders committed to establishing a new international fund on "loss and damage," addressing the obligation for wealthy, high-polluting countries and companies to pay vulnerable countries to help them cope with and recover from climate catastrophes. By COP28, stakeholders will define the specifics around the fund, including how it will be managed, where it will source funding, and what tools it will deploy to support the most vulnerable.

- An impressive 33 countries and 5 public finance institutions pledged to end their international public finance for fossil fuels by the end of 2022 and shift this into clean energy. In May 2022, the G7 made a similar commitment. It is estimated that this will cover $33 billion per year, which would close the gap to meeting the $100 billion climate finance goal.

- Through its national green financial system and related policies, the loan balance in China for green loans reached $1.86 trillion at the end of 2020, with green bonds issuances exceeding $100 billion.

More Ways to Make an Impact

Latest News & Resources

A Republican House majority means our clean energy progress could be threatened.

Don't let them stop the momentum in enacting game-changing climate action now!

Tell President Biden and Congress to prioritize our climate future in 2023

View All Issues

Climate Change

Equity & Justice

Human Health