Liquefied Natural Gas Has Limited Impact in Displacing Coal Emissions

The fossil fuel industry claims that liquefied natural gas will displace global coal consumption doesn't stand up against the facts.

A liquefied natural gas tanker ship docked at Venture Global’s Calcasieu Pass export facility in Louisiana

Julie Dermansky for NRDC

Holding global temperature rise to below 1.5 °C above preindustrial levels requires the world to accelerate the transition away from all fossil fuels, including fossil gas, starting this critical decade. The fossil fuel industry is selling a false narrative that liquefied natural gas (LNG) expansion is a “climate solution” because it displaces coal consumption globally. This claim doesn’t stand up against the facts. There is mounting evidence that LNG is more greenhouse gas-intensive than previously estimated, and it could even be worse for the climate than coal. But crucially, U.S. LNG has no or very limited impact on coal consumption overseas. Instead, U.S. LNG is likely competing with investments in the clean energy economy the world needs to protect us from even graver climate impacts.

To defend the industry’s spurious claim that U.S. LNG is reducing coal use overseas it would need to be:

- exported to countries with major sources of coal emissions—currently or realistically in the pipeline of development; AND

- exported for sectors in those countries that heavily use coal—not just for sectors that are using other sources of gas; AND

- be used in a manner that actually offsets the use of coal as opposed to competing with or replacing investments in renewable energy, energy efficiency, and low-carbon industry.

None of these factors are true in combination. So, let’s look at the real facts.

Where does U.S. LNG actually go?

The destination of U.S. LNG exports is shifting, making industry claims of coal displacement unsubstantiated.

Most of the recent U.S. LNG exports are going to Europe, accounting for 65 percent of total exports from January through October of 2023. The next largest buyers of U.S. LNG were in Asia with Japan (7.0 percent) and South Korea (5.8 percent) with India (3.7 percent) and China (3.5 percent) accounting for a smaller share. This shift in volumes to Europe is a response to the Russian invasion of Ukraine, as prior to the war Europe only accounted for 31 percent of U.S. LNG exports, according to Bloomberg New Energy Finance.* See figure from Energy Information Administration**.

Top export destinations for US LNG (Jan 2021-June 2023)

While Europe has been the main destination for recent U.S. LNG exports, the contracts for new LNG supply are rapidly shifting to traders and portfolio players (fossil fuel companies) looking to sell to the highest bidder. From the beginning of 2022 through September 2023, almost 72 percent of newly signed U.S. LNG contracts have an unspecified import destination, with a much smaller share to non-European markets and only 9.4 percent to European destinations, according to data from Bloomberg New Energy Finance.*. The holders of these contracts are generally companies looking to re-sell their contracted LNG volumes (see figure). The small portion of new U.S. LNG contracts not going to LNG re-sellers is going to China (13 percent) followed by Japan (5 percent), Germany (4 percent), Poland (2.8 percent), and other parts of Europe (2 percent).

Destination of newly signed U.S. LNG contracts from January 2022-September 2023; *“Unspecified” is predominately LNG resellers

Bloomberg New Energy Finance, Global LNG Contracts Database-3Q 2023 Update

These “LNG re-sellers"—also known as portfolio players—are essentially oil and gas companies, gas traders, and others that are buying U.S. LNG and selling that fossil gas to whichever country, company, or project will pay the most money. The largest holder of these new U.S. LNG volumes with an unspecified import destination is Qatar Energy (13.7 percent). Qatar is itself the third largest LNG exporter, so it is clearly not buying U.S. gas to offset their coal consumption—it is looking to make an additional profit off U.S. fossil gas. The remaining list of LNG re-sellers is a “who’s who” of major oil and gas producers and gas trading firms. Oil and gas industry giants—including ExxonMobil, ConocoPhillips, Total Energies, Shell, and Chevron – make up seven of the eight largest holders of new U.S. LNG contracts with unspecified destinations (see figure). Again, these LNG sellers aren’t major players in coal electricity generation, so there is no clear explicit connection to cutting coal electricity emissions.

Top U.S. LNG Re-Sellers, January 2022-September 2023

Bloomberg New Energy Finance, Global LNG Contracts Database-3Q 2023 Update

Do these importers use a lot of coal and is it used in sectors/industries?

The top current consumers of coal are: China (54 percent), followed by India (16 percent), the U.S. (5 percent), and the European Union (EU) (4 percent).***

No additional impact on European coal. Coal consumption in the EU is declining as they expand renewable energy, increase energy efficiency, shift industrial activity, and meet their legally-binding climate targets. The International Energy Agency (IEA) projects that coal consumption for power plants in the E.U. will be 44 percent below 2022 levels in 2026, and total coal consumption will be 64 percent below in 2030.**** So, expansion of LNG to the EU will not likely have any greater impact on this already significantly declining coal trajectory.

The EU’s climate targets imply rapid declines in both coal and fossil gas emissions. There is simply no emissions space to increase EU gas consumption to substitute for coal – both coal and gas emissions need to rapidly decline this decade as they head to zero. In fact, IEA analysis shows that EU gas consumption will need to decline by at least 26 percent by 2030 to meet its climate goals.****

Most of Europe’s fossil gas is used for home heating (55 percent), with electricity generation only accounting for around 19 percent of demand in western Europe (see figure). Given this, it is hard to argue that U.S. LNG shipped to Europe is offsetting coal since coal use for home heating is miniscule—it is simply gas replacing gas.

European Gas Usage by Sector; * BNEF Perimeter includes: France, Belgium, Italy, Netherlands, Great Britain, Austria, Germany Switzerland, Luxembourg, Island of Ireland; Data cover from 1/1/2023 thru 12/19/2023

Bloomberg New Energy Finance, European Gas Supply and Demand Balances LiveSheet

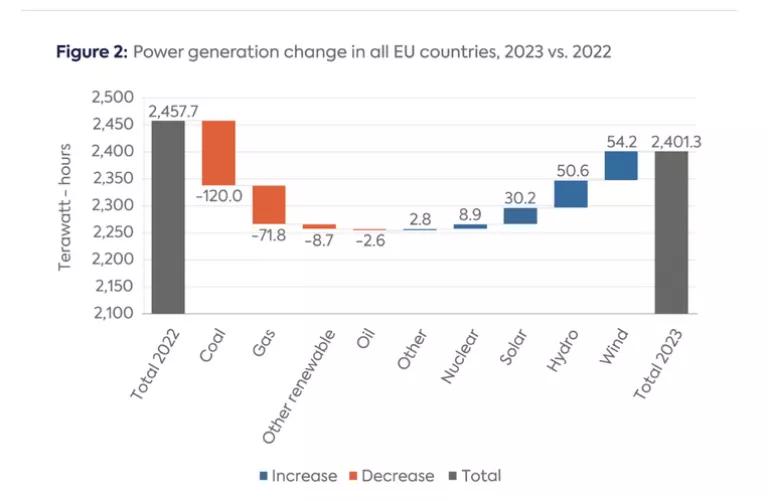

The EU is also shrinking its overall gas consumption so banking on growth in demand poses serious risks for the U.S. LNG export sector and its investors. In response to the Russian invasion of Ukraine, Europe has seen a dramatic uptake in renewable energy, which has helped offset the need for an increase in coal electricity generation to replace Russian gas previously used for electricity production. Coal electricity generation in the EU declined by 120 terawatt hours (TWh) in 2023 from 2022 levels, with wind and solar rising by 54 and 30 TWh, respectively. In fact, EU gas-fired electricity generation declined by 72 TWh last year, according to Columbia University’s Center on Global Energy Policy researchers. Europe has also seen a strong uptick in alternatives to gas for home heating with heat pump installations rising. Germany’s heat pump market grew by more than 50 percent reaching a record of almost 400,000 units in 2023.

Columbia University Center on Global Energy Policy, A Look Back at EU Power Generation in 2023

Thin arguments on displacing coal power in Asia. With Europe heading into a structural decline in overall fossil fuel demand this decade and beyond, any new LNG supply from the U.S. will scramble to find a new destination. The industry (and others) will try to claim that U.S. LNG will offset coal use in Asia. The largest current and planned Asian buyers of U.S. LNG are China, India, Japan, South Korea, and Thailand. They all have sizeable coal power plant fleets, but, outside of China and India, none of these other countries are building new coal power plants. China and India combined only account for about 7 percent of current U.S. LNG exports and only China has signed direct contracts for new LNG purchases with around 13 percent of the new deals. Again, only a small amount of U.S. LNG exports is contractually obligated to countries that currently have a large amount of current coal electricity generation or are rapidly expanding.

The vast majority of U.S. LNG is going to oil and gas companies and gas traders who will sell U.S. fossil gas to the highest bidder. Only 5.1 percent of new LNG contracts are committed directly to electric utilities, with an additional 16 percent committed to gas suppliers with some of that potentially going to electricity generation, according to data from Bloomberg New Energy Finance.

Fossil gas needs to decline to meet our climate goals

To be on a trajectory by 2030 to give us a shot at the 1.5°C goal, the world needs to cut all fossil fuel emissions by at least 35 percent below 2022 levels, according to the International Energy Agency (IEA). To be on a 1.5°C pathway, global consumption of fossil gas needs to decline by around 20 percent from today’s levels by 2030 and be on a path to a cut of over 75 percent by 2050. Coal emissions need to also rapidly decline so we need demand reductions both in coal emissions AND fossil gas by 2030 (see figure).

Source: International Energy Agency, World Energy Outlook 2023

The LNG industry can’t show us the receipts

The oil and gas industry likes to claim that U.S. LNG is offsetting coal-fired power. The industry can’t transparently show the receipts to back up those statements.

Instead of leading the world in LNG exports, the United States must curb the deeply harmful expansion of this sector and phase out all support for overseas fossil gas investments. It’s what is right for the economy, communities, and the climate.

* Bloomberg New Energy Finance data from: Global LNG Contracts Database-3Q 2023 Update.

** Data from Energy Information Administration (EIA) through June 2023. US DOE data through October 2023 shows similar trends, with a slight uptick in gas to Europe. Europe (259.7 Bcf, 67.6 percent), Asia (101.8 Bcf, 26.5 percent), Latin America/ Caribbean (22.9 Bcf, 6.0 percent).

*** Uses only data from thermal and lignite coal as metallurgical coal is unlikely to be replaced currently with fossil gas.

**** Data on 2026 E.U. coal trend based upon IEA Coal 2023 report. E.U. coal and gas demand for 2030 based upon IEA World Energy Outlook 2023 (WEO 2023) using the “stated policies”.